NPD’s Melissa Symonds looks at recent notable changes in the toy market, how 2021 ended up and how the market looks for 2022.

In the last two years, the world has changed rapidly as Covid-19 has impacted how we live, work and play together. Since 2019, the UK toy market has also changed and is now worth £3.2b with 327m units sold. Overall, in 2021 the UK market was down -3% in value for the full year, but up +2% versus 2019. This means we kept 35% of the value gained in 2020 during multiple lockdowns with both adults and children turning to toys and play to occupy their time. So how else has the market changed?

In the last two years, the world has changed rapidly as Covid-19 has impacted how we live, work and play together. Since 2019, the UK toy market has also changed and is now worth £3.2b with 327m units sold. Overall, in 2021 the UK market was down -3% in value for the full year, but up +2% versus 2019. This means we kept 35% of the value gained in 2020 during multiple lockdowns with both adults and children turning to toys and play to occupy their time. So how else has the market changed?

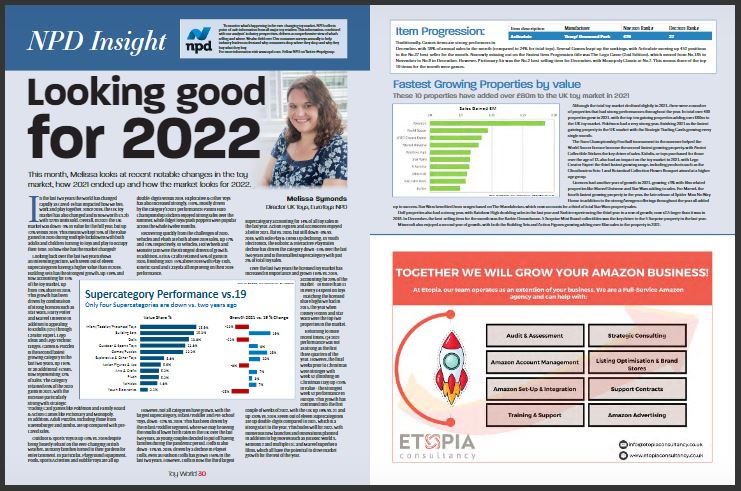

Looking back over the last two years shows an interesting picture, with seven out of eleven supercategories having a higher value than in 2019. Building Sets has the strongest growth, up +19% and now accounting for 15% of the toy market, up from 13% share in 2019. This growth has been driven by combination of strong licences such as Star Wars, Harry Potter and Marvel Universe in addition to appealing to Kidults (12+) through Creator Expert, Lego Ideas and Lego Technic ranges.

Games & Puzzles is the second fastest growing category in the last two years, up +16%. The category retained 85% of the 2020 gains in 2021, with the increase particularly strong with Strategic Trading Card games like Pokémon and Family Board & Action Games like Pictionary and Monopoly. In addition, Adult Puzzles, including those from Ravensburger and Jumbo, are up compared with pre-Covid sales.

Melissa also looks at the performance of Outdoor & Sports Toys, Explorative & Other Toys, Vehicles, Plush and Arts & Crafts, which all indicated gains, and also examines the categories that fared less well, such as Infant/Toddler and Pre-school Toys, Dolls, Action Figures and Accessories, Role Play & Dress Up and Youth Electronics.

Over the last two years the licensed toy market has increased in importance and grown +16% vs. 2019, accounting for 28% of the market – or more than £1 in every £4 spent on toys – matching the licensed share highs of 2015, the year when Disney Frozen and Star Wars were the top two properties in the market.

The article looks at Q4 2021, particularly the final weeks prior to Christmas – and the first couple of weeks of 2022.

“Seven out of eleven Supercategories are up double-digits compared to 2021, which is a strong start to the year,” writes Melissa. “This bodes well for 2022, with numerous new launches and innovations planned in addition to big movies such as Jurassic World 3, Minions 2 and multiple DC and Marvel superhero films, which all have the potential to drive market growth for the rest of the year.”

To read the full article, which appeared in the February edition of Toy World, click here.