In the June 2024 issue of Toy World, Circana’s Rory Partis looked at key trends within the toy markets across Europe, examining how they compare to the market here in the UK.

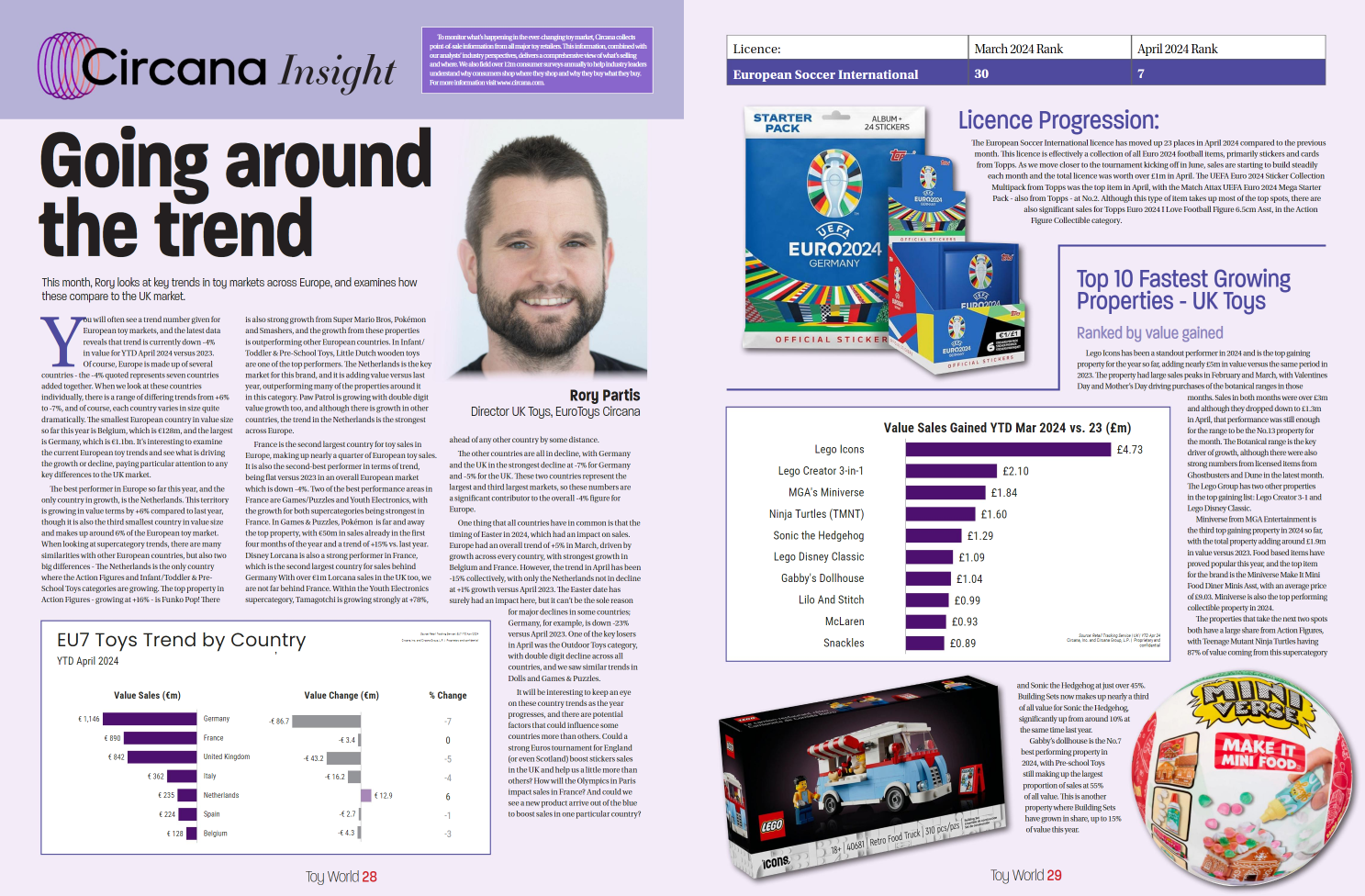

You will often see a trend number given for European toy markets, and the latest data reveals that trend is currently down -4% in value for YTD April 2024 versus 2023. Of course, Europe is made up of several countries – the -4% quoted represents seven countries added together. When we look at these countries individually, there is a range of differing trends from +6% to -7%, and of course, each country varies in size quite dramatically. The smallest European country in value size so far this year is Belgium, which is €128m, and the largest is Germany, which is €1.1bn. It’s interesting to examine the current European toy trends and see what is driving the growth or decline, paying particular attention to any key differences to the UK market.

You will often see a trend number given for European toy markets, and the latest data reveals that trend is currently down -4% in value for YTD April 2024 versus 2023. Of course, Europe is made up of several countries – the -4% quoted represents seven countries added together. When we look at these countries individually, there is a range of differing trends from +6% to -7%, and of course, each country varies in size quite dramatically. The smallest European country in value size so far this year is Belgium, which is €128m, and the largest is Germany, which is €1.1bn. It’s interesting to examine the current European toy trends and see what is driving the growth or decline, paying particular attention to any key differences to the UK market.

The best performer in Europe so far this year, and the only country in growth, is the Netherlands. This territory is growing in value terms by +6% compared to last year, though it is also the third smallest country in value size and makes up around 6% of the European toy market. When looking at supercategory trends, there are many similarities with other European countries, but also two big differences – The Netherlands is the only country where the Action Figures and Infant/Toddler & Pre-School Toys categories are growing.

The top property in Action Figures – growing at +16% – is Funko Pop! There is also strong growth from Super Mario Bros, Pokémon and Smashers, and the growth from these properties is outperforming other European countries. In Infant/Toddler & Pre-School Toys, Little Dutch wooden toys are one of the top performers. The Netherlands is the key market for this brand, and it is adding value versus last year, outperforming many of the properties around it in this category. Paw Patrol is growing with double digit value growth too, and although there is growth in other countries, the trend in the Netherlands is the strongest across Europe.

To continue reading Rory’s insights on France, Germany and the impact on sales for the rest of Europe, as well as how it compares to the UK market, click here.